| Google Ads help pay the expense of maintaining this site |

| ggg |

Click Here for the Neighborhood Transformation Website

|

Fair Use Disclaimer

Neighborhood Transformation is a nonprofit, noncommercial website that, at times, may contain copyrighted material that have not always been specifically authorized by the copyright owner. It makes such material available in its efforts to advance the understanding of poverty and low income distressed neighborhoods in hopes of helping to find solutions for those problems. It believes that this constitutes a 'fair use' of any such copyrighted material as provided for in section 107 of the US Copyright Law. Persons wishing to use copyrighted material from this site for purposes of their own that go beyond 'fair use' must first obtain permission from the copyright owner. |

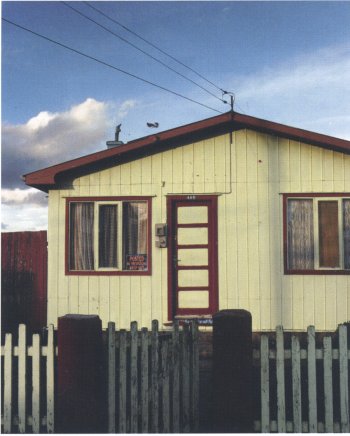

"We Buy Ugly Houses"

A Plus for Community Development?

IF YOU DRIVE DOWN A BUSY STREET IN AN URBAN COMMUNITY, YOU MAY SEE A BRIGHTLY PAINTED YELLOW AND RED BILLBOARD THAT SAYS, "WE BUY UGLY HOUSES!'

If you are like most people, you'll probably wonder what it's about. Your curiosity means that the marketing campaign has achieved its initial purpose: to create a message that people both notice and remember.

The company behind the slogan is HomeVestors, which licenses real estate investment franchises. Franchise investor (franchisees) receive training and support to buy, rehabilitate and sell or rent properties on a quick turn- around. With each sale, the franchisee pays a commission to HomeVestors.

How HomeVestors works HomeVestors' robust marketing methods target residential property owners who need to sell their homes quickly and without a lot of red tape. Reasons might include financial stress with mortgage payments, property taxes or homeowners insurance. Other triggers include divorce, job transfer, retirement or disability. Sometimes heirs seek quick cash for inherited property in "as-is" condition.

A

franchisee's goal is to purchase residential property at no more than

60 to 65 percent of its potential value and do one of three things:

rehabilitate and sell, act as a wholesaler to another investor, or

rehabilitate and rent the property.

A

franchisee's goal is to purchase residential property at no more than

60 to 65 percent of its potential value and do one of three things:

rehabilitate and sell, act as a wholesaler to another investor, or

rehabilitate and rent the property.Founded in the mid-l990s, HomeVestors now has over 240 franchises in 30 states. Many investors come from corporate America or have entrepreneurial backgrounds.

A franchise typically costs about $50,000 with a monthly fee of $500. Franchisees also pay a commission of $1,000 per property acquired. The franchisee goes through an initial training program and receives ongoing coach- ing and instruction. Properties come either from direct solicitation or through referrals from the national call center and website.

The problem of dilapidated housing HomeVestors' campaign reaches far and wide, even to the small town of Prichard, Alabama, just north of Mobile.

Prichard has a highly successful homeownership program for lower-income families and has received national recognition for its housing authority's efforts to convert Section 8 renters into homeowners. The authority has been able to build several new subdivisions as well as establish a HOPE VI housing development. But despite the successes, the city continues to be plagued with dilapidated housing units and high crime. Recently the Mobile Press-Register reported that the City of Prichard partnered with Steve Brown of the local HomeVestors franchise, Cash 4 Houses. To address the blight in several Prichard neighborhoods, Mayor Ron Davis had implemented "Operation Eyesore" to tear down derelict dwellings that attracted criminal activity.

According to the Mobile Press-Register, the hundreds of demolitions resulting from "Operation Eyesore" upset many residents who instead saw lost opportunities to preserve or create homeownership. The partnership with Cash 4 Houses is a new effort to help stabilize the neighborhoods in greatest need by purchasing, renovating and reselling the houses.

Some owners complained that they intended to fix up their house, but didn't have the money to make repairs. Mayor Davis responded that owners who are unable to afford repairs will receive a greater amount through Cash 4 Houses than through demolition.

Cash 4 Houses' Steve Brown said his business aims to add homeowners to the Prichard tax rolls as opposed to creating rental properties with absentee landlords. Many private investors are not willing to go into blighted communities to create affordable housing without bulldozing first and starting from scratch.

Seeking a multi-faceted approach Some still voice concerns about Cash 4 Houses, especially regarding the quality of the renovation work. Some critics question whether HomeVestors can provide a viable community development template for communities seeking a cost-efficient way to rehabilitate existing housing stock while eliminating eyesores. Perhaps - but HomeVestors cannot be a singular approach. In Prichard, for example, much work has been done to improve housing and much more human and economic capital will be needed to completely eliminate the community's blight and crime.

What are the key elements for success? To revitalize such a community, leaders must engage many strategies and partners. Examples of approaches include the following:

* Roll out the program in phases, block-by-block, targeting one small area for each phase to show the effect of the rehabilitation and the resources invested. Map out each house in the targeted community, determining the owner's ability or willingness to fix up their property or sell to an investor.

* Resell homes only to those who would be owner occupants.

* Use other public and private partners to create programs to assist resident-owners in repairing their properties, possibly through grants and low-interest loans.

* Engage other housing nonprofits to construct infill housing on vacant lots. The City of Prichard Housing Authority would be the most likely candidate.

* Deploy crime prevention, recreation and other community educational programs in the targeted area.

The City of Prichard Housing Authority has done an outstanding job of increasing the number of new housing units in the city, increasing homeownership, and attracting both area renters as well as families from outside the community. But a lot of work still needs to be done in older neighborhoods to achieve enough safe and decent affordable housing to satisfy demand.

Using money from private investors to purchase and renovate some of these homes can be one piece of a more comprehensive strategy. With the help of many partners and a well thought-out plan, Prichard's blighted areas can be revitalized to attract potential homeowners. While they come to the problem from different angles, both Mayor Ron Davis and Home Vestors' Steve Brown share this goal.

This article was written by Michael Mimer, regional community development director in the Atlanta Fed's Birmingham Branch.

References

Bergsman, Steve, "They Buy Ugly Houses," Mortgage Banking Magazine, June 1, 2006.

McClendon, Robert, "Prichard, 'Ugly House' people team up to wipe out blight," Mobile Press-Register, March 23,2007.